Insights to Accelerate International Expansion

USA Handbook

Our Mission: Help Manufacturers “Spend time Selling to Distributors versus Searching for Distributors”

The USA has served as a growth

market for European traders for more

than 400 years. Waves of immigrants

have landed on the USA’s welcoming

shores. Early arrivals hailed from the

United Kingdom and France. Slavery

delivered more than 600,000 Africans

between 1700-1820. The industrial

revolution lured people from European

countries including Italy, Germany,

Ireland, Greece, and Sweden. The last

50 years have redefined the USA again

with almost 65 million citizens of

Hispanic descent and 20 million of

Asian heritage. The result is a melting

pot of cultures which creates a unique

appreciation of food from every corner

of the world.

USA Today

The USA is the world’s largest consumer

market with 333 million people and retail

sales exceeding one trillion dollars. It’s

a young country, with 31% of the

population under the age of 25. Many

exporters make the mistake of labeling

the USA as a “mature” market, with low

growth expectations. The reality is that

the USA offers some of the best

opportunities on the planet. This fact is

validated by the combination of a large,

wealthy population, that is adventurous

in food habits. The retail industry is

robust, with large stores bursting with

food choices from around the world.

Export Solutions recognizes that most

exporters maintain business in the USA.

However, our experience is that most

international brands’ sales levels are

modest relative to the size of the USA

population and category development.

Barriers to success include competition

versus USA produced brands and

difficulty in funding marketing and sales

development activities. Export Solutions’

goal with our “Sell to the USA” handbook

is to provide logical strategies, insights,

contacts, and facts for international

brands looking to build sales in the

vibrant USA market.

In This Issue

1,100 USA Experts

Export Solutions features the most

extensive database of USA food brokers,

distributors,and importers. Our

proprietary information covers experts

dedicated to every USA trade channel,

major customer, and region. This includes

specialists for Italian, Spanish, British,

German, Asian and Hispanic food plus

other supermarket categories. Export

Solutions tracks more than 566 food

brokers, as well as 598 food importers

and distributors. These lists can be

purchased individually or as part of

an annual subscription to our database

which covers 96 countries and more

than 9,200 distributors. Access now

at www.exportsolutions.com.

Selling to the United States

Page 2

USA: Bigger than BRIC?

Page 8

Export Solutions: 15 Common USA Issues

Page 17

USA Market Entry Alternatives:

Broker versus Importer versus Direct?

Page 23

Brand Owners: What Every

USA Broker Wants to Know

Page 50

5 USA Labeling Regulation Tips-FDA

Page 51

How Well Do You Know the USA?

50 Industry Terms and Definitions

The state of California ranks as the world’s

8th largest economy, larger than India

or Italy. USA population expanded by

51 million people since 2000, an increase

greater than the size of Canada. Americans

are spenders by nature, with 85% of the

population able to regularly purchase

supermarket brands. All international

companies export to the USA, but per

capita sales levels are usually very small

relative to potential. Export Solutions

believes that many international brands

would see a higher return on investment

through efforts to build a stronger

franchise in the USA versus waiting

for “BRIC dreams to come true.”

Global Marketplace

Americans are spoiled with an

overwhelming assortment of food

options. An average USA supermarket

stocks more than 40,000 unique items

in a 50,000 square foot store. Shelves

showcase products from around the

world. During one week, a typical family

would enjoy a mix of Italian, Mexican,

and Asian food to supplement meals

based upon meat, vegetables, and

potatoes. American cuisine has

assimilated into international cuisine

reflecting the rich heritage of ethnic

diversity. This creates an open gateway

for brands from every continent.

Americans are receptive to new and

emerging flavors which is a significant

point of difference versus BRIC markets

which tend to remain glued to traditional

eating habits and choices.

13 Different Trade Channels

USA retail business exceeds 1 trillion

dollars, through 13 unique trade

channels. Each USA trade channel

maintains a unique set of buying

practices and selling experts. 40,000

supermarkets account for 52% of the

food business, followed by 4,000

Supercenters (primarily Walmart),

and 1,400 high volume Club stores.

Gourmet food stores such as Whole

Foods and ethnic supermarkets

represent core outlets for

international brands. Sales via the

internet are an emerging, high

growth, channel offering visibility

and availability. Homesick expatriates

and food enthusiasts now discover

hard to find products instantly online

versus the historical approach of

hauling overweight suitcases from

trips overseas. Foodservice is an

enormous channel, but focused

on commodity products produced

in the USA.

Three Phase Approach: Crawl, Walk, Run

Too many international brands are

misaligned with a focus to sell to

Walmart or even Kroger before they

have established a meaningful track

record with other retailers. A key

insight is a finely tuned strategy

focused on winning with a few high

potential, trend setting retailers prior

to approaching the “Giants.”

Normally, we recommend initial focus

on ethnic and gourmet retailers such

as Whole Foods and Fresh Market.

After success, consider expansion to

upscale supermarket chains such as

Wegman’s and Harris Teeter. Phase III

should provide a track record and

investment base to approach mass

retailers such as Walmart, Kroger,

and Albertsons.

USA: Bigger than BRIC?

USA Fast Facts

Population 333 million

GDP/Per Capita $69,069

Number of Supermarkets 40,000

Gross Margin (Supermarket avg.) 28%

Slotting Fee (avg. per store/item) $50

Food Brokers 566

Food Importers/Distributors 598

continued on next page

2

3

Who is Your Food Broker?

Food brokers dominate sales through the

USA supermarket channel. Brokers provide

critical mass and local relationships.

Services include key account sales, category

analysis, trade marketing, and essential

retail coverage. Store level representation

is mandatory to insure compliance with

headquarter authorized plans. Brokers

range in size from the massive “Big 3”

which feature more than 20,000 employees

each to smaller specialists focused against

one retailer. Export Solutions’ database

tracks over 566 brokers covering all markets

and channels. Leading USA importers

partner with brokers to provide the local

expertise and store merchandising services

required to succeed.

Calibrate Expectations to Investment

Imagine approaching Carrefour, Metro,

or Tesco with a new brand with “net, net

pricing” and limited marketing support.

The USA market is no different, with a

menu of account specific programs

required to build your brand. If you don’t

invest, you will always be anchored to

niche status at best. Retailers such as

Costco with their demo programs and

Shop Rite retain good reputations for

delivering incremental cases for your

trade spending.

Success Stories:

Barilla, Bonne Maman, and Walkers

Case studies exist for international brands

to successfully develop the USA market.

Barilla is the USA’s leading pasta brand.

Success strategy included building a USA

factory to offer competitive pricing,

highlighting their Italian heritage, and

alignment with a leading USA food broker.

Bonne Maman and Walker’s trajectory

followed patient paths. Both brands built

a base in the upscale retail sectors, before

moving mainstream to mass availability.

A core message was the ability to upgrade

category sales and profits with a high

quality, premium option. Both companies

invest in having USA based sales managers

versus managing via remote control from

Europe. Other European brands have

developed massive businesses through

unique programs dedicated to Costco.

USA Business – Next Level Strategies

European brands frequently hire Export

Solutions to provide insights on taking

their current USA business to the “next

level.” Our sales oriented approach

involves market analysis, “lessons

learned” and recommendations of

sensible options to grow your business.

Suggestions normally include laser

focus on brand building at high

potential customers plus best route

to market partners (importers/brokers)

by trade channel.

The USA still offers tremendous growth

opportunities for many international

brands. USA success requires the same

formula as BRIC markets. Higher levels of

investment may be required to win in the

USA. However, market dynamics are more

transparent than BRIC and purchasing

power ranks among the highest in the

world. Contact Greg Seminara at

[email protected] for more

information on taking your USA business

to the next level.

USA: Bigger than BRIC?

continued from previous page

Good USA Chains for International Brands

Retailer Type Sales (billions $) Stores

Ahold-Delhaize Supermarket 56 2,050

HEB - USA Supermarket 32 355

Meijer Supercenter 23 260

Wakefern/Shop Rite Supermarket 18 361

Whole Foods Gourmet 17 510

Hy Vee Supermarket 12 285

Giant Eagle Supermarket 11 216

Wegmans Supercenter 11 106

Harris Teeter Supermarket 8 260

Sprouts Gourmet 6 370

Raleys Supermarket 4 126

Fresh Market Gourmet 1.8 159

World Market Gourmet 1.0 242

Gelsons Supermarket 0.8 27

Kings Supermarket 0.4 19

4

“The Right Way” – USA Launch

Retail buyers and distributors are receptive to brand launches from multinationals. Why?

Multinationals succeed, as they introduce new products “The Right Way.” Export Solutions recaps

30 components of launching “The Right Way.” Exporters create magic with limited budgets!

Winners check as many boxes as possible on “The Right Way” scorecard.

Product Retailer

o Meaningful innovation – not “me too” o Boost category sales, margin, and profit

o Consumer market research insights o Syndicated data (Nielsen) – category facts

o Technical confirmation of product differentiation o Invest in retailer “push” programs

o Reasonable retail price – premium (not sky high) o 4-6 high value promotional events per year

o Test market results – similar country or retailer o Retailer VP, broker/distributor CEO at intro call

Marketing Excitement

o 360 marketing plan: TV, in-store, social, PR o Launch party – memorable location

o Sampling o PR, social media, trade press

o Social media o Celebrity endorsement

o Displays: end of aisle and shelf blocks o Distributor sales contest

o Special offers – retailer fliers o Donation to local charity

Team Scorecard

o Broker/distributor – best in class o Year 1: invest; year 2: break even; year 3: profit

o Local manager – launch oversight o Sales volume (retail sell-out)

o Marketing, social media, PR agencies o Market share

o Brand/technical resource from headquarters o Retail availability (weighted distribution)

o Total distributor engagement: reps. to CEO o Year 2 commitment and enthusiasm

Export Solutions’ New Distributor Checklist

____ Contract/Agreement

____ Price Calculation Model

____ Business Plan: objectives, marketing,

spending, key dates

____ Category Review: Pricing, Shelf,

Assortment, Merchandising

____ Label Compliance

____ Shelf Life

____ Order Lead Time

____ Minimum Order

____ Pick up Point

____ Payment Terms

____ Payment Currency

____ Damage Policy

____ Product Registration

____ Forecast: Year 1

____ Pipeline Order & Inventory

____ Brand Facts

____ Product Samples

____ Appointment Letter

____ Brand Specifications in System:

Distributor & Customers

____ Training: Key Account Managers,

Retail, Administrative Staff, Warehouse

____ In Store Standards: Pricing, Shelf

Management, Merchandising

____ FAQ’s/Handling Common Objections

____ Key Account Presentation

____ Customer Appointment Dates

____ Category/Business Review:

Tailored to Each Key Account

____ Retail Sales Contest

____ Checkpoint Calls

____ Market Audit Date

____ Reporting: Track Distribution, Pricing,

Shelf Positioning, Merchandising, etc.

5 Critical Questions to Thrive in 2025

1. Are we willing to pursue USA acquisitions?

2. Would your company consider USA contract packing (versus export)?

3. Can we test a high spend investment plan (“The Right Way”) in a USA region?

4. Would your company invest aggressively in USA head count in advance of sales?

5. Can we implement the USA playbook? USA factory, broker network, competitive pricing,

USA team, channel strategy, 30-50% of sales on trade promotions?

5

6

• Analyze USA opportunity

for your company:

Category review, gap analysis,

and “size of the prize”

• Next level development plan

for brands already selling in

the USA:

What’s working? What’s not

working? What to do next?

• Broker/Distributor/Importer

Identification:

National, Regional, or Trade Channel

specific solutions. Export Solutions

database tracks 566 USA brokers

and 598 distributors/importers.

• Develop strategic plan for USA:

Priority brands, pricing model, regions, customers, and partners.

• Are you ready for USA?

Label compliance, company credentials presentation in USA format, etc.

How We Help

Hire a USA Expert

• USA strategy recommendation

• Category analysis and

plan development

• Identify priority channels,

regions, and retailers

• Broker/Distributor

identification Specialist

• Have a USA pro with 20+ years experience on your team

Contact Greg Seminara at

(001)-404-255-8387 to discuss your

USA development project.

www.exportsolutions.com

Contact us for a copy of our Selling to the USA Handbook. This free guide is packed with practical insights,

market facts, and best practices to advance your business to the next level in the world’s largest market.

7

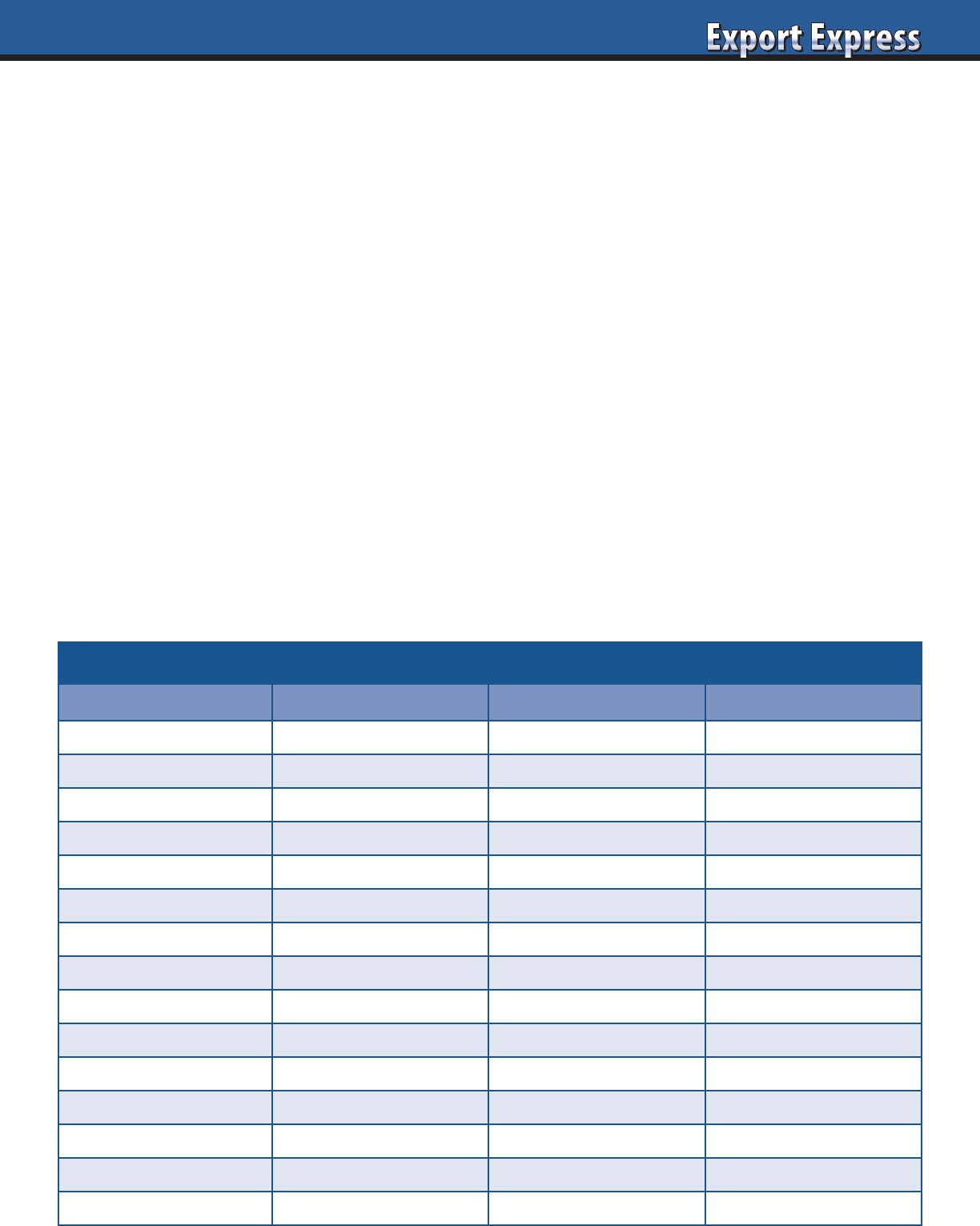

Made in USA Brands

Food products produced in the USA sell through 13 different

trade channels. Supermarkets always represent the largest

channel with 52% of sales. However, this represents a continuous

shrinkage from the dominant 85% share of food sales enjoyed

by supermarkets in the nineties. Walmart’s Supercenters are

the number one customer for virtually all mainstream USA food

brands, catering to the value oriented consumers. Kroger ranks

as the top supermarket chain reaching across the income

spectrum, but viewed in most markets as the supermarket of

the suburbs. Costco & Sam’s Club stores represent an important

customer for number one brands in large categories.

Imported Brands – Retail Destinations

Supermarkets still account for 60% of sales revenue for food

brands produced outside the USA. Frequently, international

brands derive their revenue from different supermarket chains

than the mass market. Imported brands naturally do well at

upscale supermarket chains like Wegman’s. Consider Shop Rite,

a 361 store chain that moves high volumes and their customers

love international brands. Gourmet retailers such as Whole

Foods and Fresh Market serve as prime showcases for foreign

products. I love Eataly’s six stores and Dean & Deluca’s three

deli’s but they represent a small fraction of Manhattan, let alone

the broader USA market. Ethnic grocery stores account for

important business for homesick expats missing their favorite

international foods. Amazon’s internet shopping platform is

an emerging destination for international foods.

USA Entry Cycle

Normally, international brands start first in the ethnic channel.

Demonstrated success creates opportunities to enter gourmet

stores like Whole Foods and upscale and regional supermarket

chains. Phase three provides critical mass to gain access to large

supermarket chains such as Kroger, HEB, and Publix. The final

step is to create demand for access to Walmart Supercenters and

mainsteam supermarket chains like Ingles and Acme. Brands

trying to “skip the cycle” and go to Walmart or Kroger too early

will probably be delisted quickly, preventing access when you

are ready.

OTC/Personal Care Brands Channels

Non-food brands including household products, personal care,

OTC, and general merchandise typically depend on different

channel splits. The “mass” channel which includes total Walmart

and Target may represent 50% of the business or more.

Pharmacies account for around 30% of the business for OTC

and personal care brands. Supermarkets also represent at least

20% of the business for all these categories, more for paper

goods, laundry and cleaning products.

National Versus Regional Retailers

There are no national USA supermarket chains. Top 10

supermarket retailers operate across multiple states, creating

challenges for targeted marketing. This provides further

validation for new entrants to focus on upscale regional chains

where they can test marketing investment alternatives. Walmart,

Target and “Big 3” drug chains are national.

Supermarkets Clubs

Supercenters All Other

Supermarkets E-commerce

Ethnic/Gourmet All Other

Sales By Channel: USA Brands vs. Imported

Sales By Channel

USA Food Brands

Sales By Channel

Imported Brands

Export Solutions: 15 Common USA Issues

Key Issue Solution

Difficult to manage USA from abroad.

Hire one national sales manager to manage business.

Or consider contract sales management team like Ram Group.

Headquarter authorization for my brand, but

I can’t find it at retail.

Hire a broker for store level coverage.

Store level distribution may be 60% or less without broker coverage.

My brand sells well in New York, but not

elsewhere.

New York is unique and represents only 7% of USA population.

Markets like Atlanta, Dallas, Phoenix & Seattle are more representative.

Slow sales from the shelf for my product.

Try a coupon (Sunday insert or on-pack).

Increase TPR allowance level from 10% to 25%.

Walmart doesn’t want my product.

Walmart sells basic items for value conscious consumers.

Recommended focus: upscale retailers Whole Foods, Publix, etc.

My broker is a “one man” organization.

Large Brokers (Advantage or Crossmark) have 20,000 employees.

Find a broker offering retail coverage and category analysts.

My Importer (or Broker) claims sales to Kroger

or Albertsons, but sales are low.

Check number of chain stores where your brand is authorized.

Kroger has 2,726 stores. How many are you in?

Importer/Broker is not achieving objectives.

Export Solutions provides independent guidance on

assessing your business and providing realistic solutions.

Secure distribution without paying listing fees.

Target the ethnic channel and non-slotting retailers

like World Market & Trader Joes.

Fancy Food Shows not generating

quality buyer contacts.

Try Exhibitions focused on your Category.

Sweets and Snacks for Confectionery, NACS for Beverages etc.

Importer/Broker achieves results at East Coast

supermarkets, but struggles elsewhere.

Appoint channel and customer specialists.

No one importer or broker is successful everywhere.

How do I secure distribution at Costco? Great quality, large size pack, and commit to demos.

Is Private Label or Foodservice worth the effort?

Private label/foodservice dominated by local producers.

Focus energy on upscale supermarkets first.

I know a guy with connections at Kroger,

Walmart, etc.

200,000 + sales people in USA with customer relationships.

Partner with a “company” with valid business track record.

Brokers are not interested in representing

my brand.

Offer to pay a minimum pioneering fee, with a success bonus.

8

USA Retailers – 30 Channel Specialists

Channel Customer Dollar Sales (billions) Comments

Club Costco 140 Revenues from 575 USA stores

Club Sams 75 Revenues from 600 USA stores

Club BJ's 15 225 stores. Primarily North/Florida

Distributors UNFI 27 Supplies Whole Foods, Stop N Shop etc.

Distributors Kehe 5 Supplies Publix, HEB etc.

Distributors DPI 1 West/Mid-Atlantic

Dollar Dollar General 33 18,500 stores

Dollar Dollar Tree 14 7,850 USA stores

Dollar Family Dollar 12 8,100 stores

E-commerce Amazon 275 Online USA sales (ex. web services)

Foodservice Performance Food 45 Includes Core-Mark

Foodservice Sysco 44 National, reflects USA sales only

Foodservice US Foods 30 National

Foodservice Smart & Final 4 254 cash & carry outlets

Gourmet Whole Foods 17 510 USA stores

Gourmet Trader Joes 18 530 stores

Gourmet Sprouts 6 370 stores

Hard Discount Aldi 20 2,100 stores

Hard Discount Save A Lot 4 900 stores

Hard Discount Lidl 1 155 stores in East and South

Pharmacy Walgreens 115 9,020 Pharmacies

Pharmacy CVS 100 9,962 Pharmacies

Pharmacy Rite Aid 17 2,488 Pharmacies

Supercenters Walmart 370 Sales for 3,571 supercenters

Supercenters Target 105 Total sales for 1,900 stores

Supercenters Meijer 23 260 Stores in Central USA

Wholesalers C & S 30 Supplies 7,700 stores

Wholesalers Associated – Kansas City 12 South/Central USA

Wholesalers Spartan Nash 10 Central USA

Wholesalers Bozzuto’s 0.5 Northeast, supplies 1,200 stores

9

Retail buyers are challenged to maximize profits and sales from every available inch of shelf space. Every new item accepted must

improve on the performance of the brand currently occupying that space. Buyers are overwhelmed by new product offerings, all

with ambitious promises. Improve your chances of success by incorporating Export Solutions’ 10 point check list on how to excite

your category buyer about your new product.

How to Excite Buyers – New Product Checklist

Buyers: New Product Assessment

High Interest Low Interest

Category Opportunity Large or high growth Declining or niche

Brand Owner

Multinational or proven local.

Category expert

New foreign supplier

or start-up

Innovation

Something new, supported

by consumer research

“Me too” product

Profit Margin

Enhance current

category margin

Equal to or less than

current category margin

Sales Generates incremental sales Cannibalizes existing sales

Marketing Investment Sampling, social media, PR None

Trade Programs Invests in retailer “push” programs Periodic discounts/rebates

Brand Track Record Successful at other local retailers Unproven in the country

Terms/Conditions Attractive deal structure Typical terms/conditions

Representation Dependable local distributor Small, niche entrepreneur

10

11

Europe and USA combined populations

exceed one billion people. These

developed markets serve as the source of

most of the innovation and inspiration for

the food and consumer goods industry.

Yet the clear fact is that most European

manufacturers sell minimal quantities

to the USA, and American brands are

virtually absent from European

supermarkets. Multinationals like Nestle,

Unilever, Coca Cola, and P & G are

exceptions and play in a different league.

Congratulations to brands like Barilla,

Tabasco, and Pringles that achieve strong

results on both sides of the Atlantic.

However, the list of winners on both

continents is short. This issue of Export

Express explores Lessons Learned and tips

for “Cracking the Code” in the worlds

“First Billion” consumer market.

Euro – USA Importance

Some brands avoid the battle and shift

strategic focus to high growth markets of

Asia, Latin America, and the Middle East.

This approach makes sense for companies

that view export as an opportunistic

source of volume or do not own leading

bands. For most, Europe and the USA

remain attractive targets due to the large,

affluent, populations concentrated in

organized markets. Consumers in

established countries value innovation

and maintain the disposable income

to purchase international brands.

An important point is that Europe

and the USA share many similarities

in eating, drinking, personal care

and home cleaning practices. This

environment creates instant consumer

understanding of our brands features

and benefits versus markets such as Asia

where the vast majority of consumers live

and eat differently.

Problem: “Me Too” Products

Many leading food segments maintain

similar development factors in the USA

and Europe. Supermarkets on both

continents dedicate significant space

to universal categories such as Cookies

(Biscuits), Coffee, Cake Mix, and Cereal.

Innovation sweeps the globe, so it is a

major challenge to differentiate versus

existing choices. In our home countries,

we enjoy the benefits of local

manufacturing, scale, and a tradition

of linkage with the consumer. However,

these benefits disappear quickly as a USA

brand attempts to sell to Europe or vice-

versa. In fact, drawbacks emerge

instantly, starting with overseas freight,

duties, and distributor service fees. These

routine costs translate to dramatic price

premiums where your product may cost

2-3 times on the shelf versus comparable

local brands with years of marketplace

heritage. In reality, your initial overseas

business base may consist of homesick

expatriates willing to pay any price

for their favorite candy or tea brand

from home.

Shopping Habits

A typical USA supermarket averages

50,000 square feet and stocks more than

40,000 unique items. Private Label is

present, but accounts for only 19% of total

sales. As a result, USA stores have plenty

of space for international brands willing

to “pay to play.” USA shoppers visit 4-5

stores per week across different trade

channels, always on the hunt for bargains.

Europe features a mix of large and small

stores, but the reality is that the common

supermarket is only half the size of a USA

store. Shelf space is very limited, with real

estate allocated to fast moving brands and

private label. Gaining entry to European

stores is a challenge for local producers,

let alone foreign brands.

What is Your Pull Strategy?

Congratulations! Your brand has been

listed at a European supermarket.

The good news is that you may achieve

a respectable level of sales simply by

being one of the small number of choices

on the shelf. Naturally, sales will be

proportional to your investment in

consumer awareness and trade promotion

activities. Globalists will argue that it is

much easier to get on the shelf in the

USA, but much tougher to “sell out.”

USA consumers face a sea of choices

and dedicate less than 10 seconds to

making a purchase decision. Success in

the USA demands investment in coupons,

trade ads and price reduction offers.

Investment Level

The USA market includes 333 million

consumers. German population hovers

around 83 million, with France and

the UK weighing in at 67 million and

67 million, respectively. Brand owners

should ask the fundamental question

of “What a $100,000 investment buys in

their country?” Then, that investment

should be divided by the number of

people in your target country. For

example, $100,000 allows some

meaningful activity in a country like

Denmark or Ireland or Chicago. On the

other hand, $100,000 is a small sum for

the entire USA or even Canada which has

38 million people. Best practice suggests

using your “$100,000” budget to drive

high impact promotions at a handful of

USA retailers or 1 or 2 European countries.

Brokers Versus Distributors

Food brokers are the dominant

outsourced model for selling to the

USA supermarket channel. Virtually all

companies from giants like Nestle and

P & G to start-ups hire brokers. Core

broker services are key account selling,

category management analysis and

mandatory retail merchandising. In the

USA, the term “distributors” refers to

wholesale distributors like UNFI who

handle slow moving specialty food

items. USA importers play a role for

international brands, but represent only

one percent of USA turnover. In Europe,

distributors serve as the key partners for

foreign brands. Distributors provide an

Europe vs. USA – Vive La Différence

continued on next page

12

integrated portfolio of selling, logistics

and financial services. As with brokers,

there are significant differences in

capabilities between giant power

distributors and small “one man show”

companies. Export Solutions’ distributor

database tracks more than 2,840 European

distributors and 536 USA brokers.

Crawl, Walk, Run

USA brands looking to enter Europe

should target the UK and Ireland as their

first point of entry. Find a distributor with

a successful track record at importing

other USA brands. Waitrose, Whole Foods

Costco, and perhaps Asda (Walmart) may

be logical first customers. Next stop

would be the Nordic region which values

premium products and contains many

excellent distributor options. Many

European brands are already in the USA

with modest sales. Hire a USA based

employee and locate a “mid-size” broker

to handle your brands. Focus on a limited

number of upscale supermarket chains

with 50-150 stores each. Invest in trade

activities to do it right at these accounts

prior to expanding attention to giants like

Kroger and Publix.

Need a Hand?

Export Solutions can help on both sides of

the Atlantic! I have been a featured speaker

for ESMA, the European Distributors

Association and am well connected with

distributors throughout Europe. I have also

spoken to European manufacturer groups

in Germany, Italy, and the UK on USA

entry strategies. Export Solutions has

helped Italian, German, UK, and Dutch

companies on USA business development

strategies. Our approach is “sales

oriented,” focused on creating tangible

solutions to create new sales.

Europe vs. USA – Vive La Différence

continued from previous page

USA Population by Region Population (millions)

Percentage of USA

Population

South 128 38%

Northeast 57 17%

Midwest 69 21%

West 29 24%

Total 333

*estimated 2022

13

The USA represents the world’s largest market. A small market

share in the USA can represent a bigger business than owning

a 50% market share in a smaller country. Many international

brands fail to reach their potential in the USA as they treat it as

just another export market. Listed below are Export Solutions’

ten tips for improving your results in the USA, a consumer

market of 333 million people.

1. Develop a Channel Strategy

The USA Food business is segmented into 13 channels, with

supermarkets claiming an average of 52% of the business. Other

important channels include Supercenters, Mass, Foodservice,

Value, Club, Convenience, Natural, Gourmet, Internet, Military,

Gift, and Ethnic. One strategy is to concentrate efforts on winning

in one channel to gain traction, versus spreading efforts in too

many areas.

2. Optimize Results at Top 10 USA Retailers

Think Walmart, Kroger, Publix, and Food Lion that all operate

more than 1,000 stores. Many companies claim that they “sell to

Walmart.” The key question is to identify a chain’s store count

and measure how many of those stores your brand is available

in. Last year, an important European beverage brand told me

that they were “selling to Walmart.” Turns out that his follow up

investigation revealed that he was selling to only 46 of Walmart’s

3,571 supercenters.

3. Think Beyond New York

None of the top 5 grocery retailers maintain a presence in metro

New York. The USA has experienced a population shift to the

South and West, with the Northeast actually representing the

smallest of the four regions. Visit Atlanta, Houston, Los Angeles,

or Miami to get a more accurate gauge of industry dynamics.

4. Use a Broker

In the USA, the brokers play a unique role, touching virtually

every brand in the supermarket aisles. Even importers use

brokers to supplement their own efforts. Export Solutions’

database tracks 536 USA brokers, including the “Big 3.”

5. Retail Services are Required

Great news! You just received a listing at Kroger or Albertsons.

Your work has just begun. Planogram integrity is an enormous

issue in the USA. Compliance levels of new items at store level

may reach only 60% without a broker at store level to “cut in”

your product and monitor its availability.

6. Data Driven Decisions

The USA market is blessed with the most sophisticated analytic

tools that are used on a daily basis. This includes availability

of point of sale data at the chain (and sometimes store) level

to measure everything that scans. Business building and selling

incorporates use of post promotion analytic tools, market basket

studies, and brand sales by demographic cluster.

7. Try a Coupon

USA Sunday newspapers are jammed with coupons offering

consumers small discounts (.25 - $1.00) to purchase a product. Many

supermarkets up the ante, by doubling the value of the coupons.

This is a proven strategy to drive listings, generate trial, and repeat

purchase. A coupon can force a retailer to carry your product, as he

does not want to disappoint a customer with a coupon.

8. Hire a Sales Manager

An international company should place at least one person in

the USA to manage their interests. Hire a veteran sales person

and locate him in a home office in a city with a great airport like

Atlanta or Chicago. This role will allow him to manage your

distributor and broker network. You can also hire a contract sales

management group like Ram to perform this function. Hiring an

employee based in the USA signals that you are serious about

building your business in the USA.

9. TPR

This stands for Temporary Price Reduction. USA supermarket

aisles are filled with hundreds of these tags. The consumer

recognizes these tags to signal a special discount and “time

to buy.” TPR’s are normally 10% of everyday price and can be

an efficient spend particularly on a “scan down” program.

10. Ethnic Channel: First Stop

Your product will be well received in channels specializing

in your country’s products. There are well established retailers

specializing in Hispanic, Asian, British and Italian Foods.

Whole Foods and Cost Plus World Markets offer good

assortments of international brands.

Ten Tips for Foreign Brands: USA Growth Strategies

Good USA Chains for

International Brands

Retailer Stores

Ahold-Delhaize 2,050

HEB – USA 355

Meijer 260

Wakefern/Shop Rite 361

Whole Foods 510

Hy Vee 285

Giant Eagle 216

Wegmans 106

Harris Teeter 260

Sprouts 370

Raleys 126

Fresh Market 159

World Market 242

Gelsons 27

Kings 19

14

USA vs. Europe

Differences – Industry Fundamentals

USA Europe

Store Size (avg.) 50,000 sq. feet 20,000 sq. feet

Unique Items/store 40,000 18,000

Private Label Value Share 17% 25-50%

Price List (wholesale)

Same pricing model

for all retailers

Price may vary by retailer

Annual Negotiations Category Review Standard Practice

Organizational Model Food Brokers Food Distributors

Data Transparency Account/Store Level Data Country Level Data

Store Level Service

Merchandisers required

for compliance

Conditions controlled by

Chain Headquarters

Retail Coverage National/Regional Unique retailers by country

Sunday Coupons Popular Practice In-ad only

Note: Every market maintains differences. However, industry manufacturers

everywhere share the common goal of securing more shelf presence while retailers

demand more discounts.

15

USA Sales – Next Level Strategies: 10 Tips

Most European brands remain frustrated by their lack of progress in the USA market. Many companies completed a first step,

with listings at World Market and Eataly (6 stores), but failed to gain traction at big chains with 200+ stores.

June Fancy Food optimism fades by October. Your boss is committed to the USA, but demands better results before bigger investments.

What do you do? Call Export Solutions!

Assessment Area Considerations Insights

Consumer Target

Who is your target consumer? Millennials, foodies, homesick expats

Channel Strategy

Unique strategy required: upscale supermarket,

e-commerce, specialty, and mass retailers

Priority: Upscale supermarkets, gourmet stores,

ethnic stores, e-commerce

Route to Market

Channel, regional, and customer experts required Determine ideal broker profile.

Focus first on good brokers, then buyers.

USA Manager

Mandatory oversight of your USA development Results proportionate to salary.

Locate close to distributor or Atlanta, Chicago

Trade Promotion

Customer specific plan required Invest in strong programs at 10 key retailers.

15% TPR promotions will not excite anyone.

Export Solutions

USA market development helper for

European brands

Point of difference: Retail reality focus.

Targeted, logical road maps. Sales oriented.

Cost to Serve

Implement strategies to reduce price gaps versus

“Made in the USA” products

Evaluate options to create more efficient cost

structure: factory gate to store shelf.

Digital Savvy

What is your social media plan?

How much are you selling through Amazon?

Digital is targeted and cost effective.

Amazon grocery: growing 30% + in USA.

Lessons Learned

What is working? Why has business not scaled?

Barriers to progress?

Independent validation and solutions provided

by USA market expert.

Benchmark Brands

Which overseas brands are winning in USA? Study best practices: Barilla, Bonne Maman,

Colavita, Filippo Berio, Lee Kum Kee, Rana,

San Pellegrino, Walkers Shortbread

Retail Safari

How do I accelerate sales in the USA? Export Solutions retail safari program yields

tailored insights and best practices for succeeding

in the mainstream USA market.

Hire a USA Expert

• USA strategy recommendation

• Category analysis and

plan development

• Identify priority channels,

regions, and retailers

• Brok er/Distributor

identification Specialist

• Have a USA pro with 20+ years

experience on your team

Contact Greg Seminara at

discuss your USA development project.

www.exportsolutions.com

16

Take Your USA Business to the Next Level

Export Solutions Services

Current Business Assessment

Opportunity Gap Analysis

Customer/Channel Prioritization

Broker, Importer, Distributor Identification

USA Entry Plan

Measures: Concept to Shelf

Consumer/Trade Promotion Plan

Connect with Channel/Retailer experts

Team staffing and recruitment

Double Your Business Plans

“Spend time Selling to Distributors

versus Searching for Distributors”

www.exportsolutions.com

Analysis

Partner

Sell

17

Outsourcing of sales functions to channel specialists is a common

organizational strategy in the USA. Third party service providers

include Food Brokers (now formally known as Sales & Marketing

Companies), Distributors, Importers, and Merchandising Service

Organizations. Most retail channels require a unique approach.

How do I determine the right strategy for my brand?

Project Sales by Trade Channel to Determine the Source of Your Volume.

In the USA, there are 13 trade channels: Supermarket,

Supercenter, Mass, Club, Ethnic, Natural Foods, Convenience,

Drug, Dollar Store, Gourmet, Gift, Internet, and Military for most

food products. Hardware is important for Non-Food products

and department stores for personal care brands. Normally,

supermarkets account for 52% of sales for a food brand, but only

30% of sales for “non-food” categories like cleaners, personal

care, or health care.

Determine the Services Required and the Complexity

of Ongoing Maintenance.

Certain categories require a high focus on store level activity

and speed to shelf. In other categories, it is sufficient to “sell in”

at headquarter level and let the retailers’ systems execute for

their stores. Brokers and MSOs are the primary options for

performing in store work.

Evaluate Your Internal Resources.

How many direct people will your organization have focused

against customer development and sales execution? What can

your own organization realistically handle? Do you have people

based locally close to the retailer and people with experience

against leading retailers or trade channels?

Determine the Channel Specialists

Many companies employ a food broker for the supermarket

channel (at minimum: retail services) but prefer to deal directly

with Club, Drug, and Dollar Store channels. Importers and

Distributors function well for natural food products, gourmet

specialty foods, ethnic foods, and imported brands.

Hybrid Approach May Be Optimal

Walmart prefers to negotiate directly with its vendors. Many

manufacturers hire a broker for retail services at Walmart to

supplement their own activity at headquarters. Merchandising

Services Organizations excel at dedicated, short term projects

and handling time consuming reset work.

USA Distributors Act As Wholesalers

The USA distributor model is different from the international

model. USA distributors are wholesale distributors providing

selling, logistics, and collection services. However, they rarely

import and do not necessarily work on an exclusive basis

by category.

Importers Need Broker Services Too

Importers provide a valuable service for international brands.

They offer an integrated service portfolio. The larger importers

partner with food brokers for better penetration of the

supermarket channel. As a rule, an importer alone will not

serve as a complete solution for the USA supermarket channel.

A Broker provides local customer expertise on a national basis

plus essential retail services.

Avoid “One Man Shows”

Size matters. There are more than 200,000 sales people in our

USA industry. Everyone claims a “great relationship” with a

specific account. This is a start, but the preferred route is to

partner with a broker organization that offers critical mass,

category management, and retail services.

Big Brokers – Big Brands

“Big 3” USA brokers maintain over 20,000 employees and

impressive sales, marketing, and administrative services.

The Big 3 performance may exceed the capabilities of even

the largest multinationals. In the USA, P & G, Kraft Heinz,

Nestlé, and Unilever all depend on brokers for certain

categories and services. However, most Big 3 brokers are

reluctant to pioneer new companies or represent brands

with modest sales revenues.

Battle for Broker’s Attention

Most outsourcing to third parties represents a “shared

services” approach where the manufacturer is effectively

“renting” a portion of the broker or distributor’s sales force

time. These third parties profit by reselling this sales force

to many manufacturers, sometimes up to a 1,000 companies

in the case of a Big 3 broker. A constant battle exists for a

manufacturer to get their “fair share” of the sales force’s time.

On the other hand, manufacturers must be realistic on their

performance expectations relative to their amount of

compensation to the third party.

Conclusion

The old adage that “no one can execute better than yourself”

does not apply in most cases in the United States consumer

goods industry. In every sector, there are local specialists with

significant critical mass that can execute a well defined brand

proposition in an effective and efficient manner. Manufacturers

should focus their attention on direct relationships with global

leaders such as Walmart & Costco that require a high level

of senior management interaction. International brands may

require a variety of outsourced partners to optimize results

in distinct channels.

USA Market Entry Alternatives: Broker versus Importer versus Direct?

18

Everyone wants to sell to Walmart.

This is logical, as they rank as the

number one retailer in the USA and

Latin America, plus good presence in

the UK, China, Japan, and South Africa.

Walmart’s International business

(outside the USA) is bigger than the total

turnover of Carrefour or Tesco. Selling

to countries where Walmart has stores

makes sense for USA producers.

However, Export Solutions always advocates a strategy of making export

decisions based upon what’s best for the entire country, versus the preferences of an

individual retailer, even if it is Walmart.

Walmart’s Central American buyers have been speed dialing leading brands pursuing

direct purchase agreements. These offers may be hard to resist, but manufacturers must

be fully aware of the implications. Selling direct to Walmart International allows you to

bypass the “distributor system.” This provides Walmart with a cost advantage at store

level of around 15%. This may create a situation where it is difficult to sell to other

market customers, because their list price resembles Walmart’s shelf price.

I visited Guatemala and Costa Rica recently. Walmart places many Direct Import brands

in one aisle, away from the product’s normal category placement. These Direct Import

brands are not supported by the armies of in-store merchandisers that are common in

Latin America. I remember the story of when I served as Director of Sales for Clorox in

Buenos Aires, Argentina. Someone from corporate sold my favorite Hidden Valley Ranch

salad dressing to Walmart International and it magically appeared on the shelves of my

Walmart. I was thrilled, but apparently was the only happy customer. Most in Argentina

had never heard of Hidden Valley Ranch. Without advertising, promotion, and

distributor support, the brand gathered dust and was discontinued.

I am an advocate of partnering with distributors to sell to Walmart’s international

divisions. These local companies sell and merchandise at Walmart and all market

customers everyday. Distributors focus on brand building and can provide the muscle

at store level to push your brand. Retailers benefit because they can reorder any day

versus waiting for the container to arrive from the USA. In my opinion, the distributor

model is usually the preferred route to market to create a sustainable business in these

fast growing countries.

Many European companies are anxious to sell to Walmart's 3,571 USA supercenters.

Slow down! Walmart’s USA supercenters specialize in category leaders and fast moving

brands. Their consumer base consists of middle and lower income customers who have

limited spending power to purchase super premium brands from overseas. Also,

Walmart tends to be the “low price” leader. This may damage your ability to sell to

upscale supermarkets, as they may be hesitant to stock an item that Walmart is carrying

and selling for 15-25% less. My humble advice for European brands is to create a base

business with mid-upscale USA supermarket chains. Approach Walmart at a later stage

with your track record of market success.

Walmart is the world’s number one retailer and will serve as a major factor in our

strategic decisions. It is flattering and encouraging that Walmart wants to sell our

brands. The key is to devise the optimal route to market that builds your brand equity

and facilitates your business development to all market customers, including Walmart.

www.exportsolutions.com

“Spend Time Selling to Distributors versus Searching for Distributors”

Selling to Walmart – When and How?

Greg Seminara

404-255-8387

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

Strategic Services

Contact Us for

Export Solutions

1. Identify Best in Class

Distributors: 96 Countries

2. Best Practices

Export Strategy

3. Distributor Management

Workshops

4. Export 101:

Let’s Get Started

5. New Market

Prioritization

and Launch Plan

6. Personal Distributor

Introductions:

96 Countries

7. Walmart International

8. Distributor Contracts,

Margins, and Fees

9. Meeting Speaker

10. International

Strategy Expert

19

USA Case Studies

Export Solutions helps International brands

improve their USA sales or gain initial entry

to the USA

Client: Leading European Canned Food Brand

Project: Design USA entry strategy

and arrange meetings with

leading importers.

Client: European Ethnic Food Brand

Project: Arrange meetings with potential

importers,distributors, and brokers.

Client: Global Beauty Care Brand

Project: Organize and select

USA importer, distributor, and

broker network.

Client: UK – Non-Food Brand

Project: Design USA market entry

strategy. Hire USA manager. Arrange

meetings with leading USA brokers.

Client: Global Confectionery Brand

Project: Design strategy to improve sales

to the USA Market. Analyze category

and hire USA broker network.

Client: Asian OTC Brand

Project: Identify OTC importers

or brokers.

Client: Leading Italian Food Brand

Project: Analyze market to take sales

to next level.

Client: Your Brand

Contact Greg Seminara at

(001)-404-255-8387

to discuss your project.

www.exportsolutions.com

Top 20 USA Grocery Chains

USA Sales

Retailer ($ billions) Stores

1 Walmart SC. 370 3,571

2 Kroger 138 2,726

3 Albertsons 70 2,278

4 Ahold Delhaize 56 2,050

5 Publix 48 1,300

6 HEB - USA 32 355

7 Meijer 23 260

8 Shop Rite 18 361

9 Hy Vee 12 285

10 Wegman’s 11 106

11 Giant Eagle 11 216

12 Winco 10 135

13

Southeastern Grocers

8 419

14 Demoula’s 6 90

15 Save Mart 5 208

16 Stater Brothers 5 172

17 Ingles 5 198

18 Price Chopper 4 131

19 Weis 4 198

20 Raleys 4 129

390 USA Customers

How many are you selling to?

Export Solutions Retail Database Covers 390 Customers

258 Supermarket Chains 29 Natural Foods

46 Convenience Chains 28 Wholesalers

Features

3

Up-to-date store counts

3

Direct link to retailers’ web sites

3

Financial information for publicly traded retailers

3

86 Canadian retailers plus 2,200 retailers in 94 other countries

3

Free sample access

Order now: www.exportsolutions.com

20

Hiring the right local partner is

the third most important step in

optimizing your sales. This follows

creating a product with a unique

consumer value proposition and

willingness to invest in brand

development activities. Listed below

are some practical tips on selecting the

right company to represent your brand.

Identify a Pool of Preliminary Candidates

Create a large group of potential

candidates. This could include distri-

butors, importers, brokers, or local

producers of related products. Highlight

companies that are specialists in the

market sector that you are aiming

at. Export Solutions streamlines this

process with our online directory of

more than 9,200 distributors, importers

and brokers for 96 countries.

Establish Partner Selection Criteria

What are the key attributes of

your ideal candidate? Product

specialization? Service portfolio?

Existing results for current brands?

Choosing a Large, “Best in Class”

partner versus a “Small, Hungry”

company willing to pioneer a new

brand is an important preference.

Determine Candidates Preliminary

Interest Level

Send a brief summary of your product

proposition and company credentials

to the 5-10 most promising candidates.

A follow-up phone call to your top

candidates is an appropriate personal

connection. Brokers expressing an

interest should complete a brief

company overview recapping their

corporate capabilities: Sales, Logistics,

Marketing, etc.

Schedule a Meeting in the Candidates Office

Normally, we recommend interviewing

at least three candidates depending

on the size and scope of a project.

Schedule the meeting 3-5 weeks in

advance. Provide a specific agenda

at least 2 weeks in advance, including

pre-work such as category market

analysis. Meet the broker’s team that

would work on your business, as well

as senior management. A broker’s

office provides clues on company

culture, scale, and capabilities.

Prepare Interview Questions

and Assessment Grid in Advance

Create a list of key questions to ask

each candidate. Topics could include

local category dynamics, cost of entry,

and Distributor success stories. Create

a standard grid to evaluate and

compare all candidates on a common

platform. See page 25 for ten sample

questions for every broker interview.

Conduct an Independent Evaluation of

Candidates Performance for Existing Brands

Visit target outlets for your product

to observe category conditions. At the

same time, evaluate each candidate’s

performance for his existing clients.

Do his current brands maintain a

strong presence in the market? Or are

his brands hard to find? Conduct these

visits to leading retailers independently,

as an accompanied visit may lead you

to select stores which may not be

representative of marketplace reality.

Reference Checks Represent

an Important Next Step

Request references of 5 of the broker’s

top 10 clients. Call at least three references

and request insights into performance

and capabilities. Acknowledge that

these are likely to be positive references,

but they always provide significant value.

Run a Dun & Bradstreet or other type

of credit report on leading candidates.

Export Solutions is often hired to

conduct independent, confidential,

reference checks.

Invite Top Choice to your

Corporate Headquarters

The visit should include meetings with

senior management, factory tour, launch

planning, and mutual commitment. The

trip serves as an important bonding and

relationship building experience between

your company and your new partner.

My Way: Finding and Selecting the Right Broker or Importer

www.exportsolutions.com/ExportTips

300 Free Articles

Export Strategy

Distributor Management

21

22

Criteria (weighting)

Rating Evaluation Factors

Corporate Credentials 30%

Size, sales force, # employees.

Reputation (reference check existing brands).

National coverage. Key account teams.

Multi-channel coverage.

Category Expertise 20%

Sells brands in my category.

Shelf space for existing brands.

Current brands selling to target retailer.

Category analysis and insights.

Brand Building 15%

Ideas to build or launch my brand?

Marketing plan, cost, timing.

Success stories.

Cost to Serve 15%

Fair, transparent model relative to size

of business, brand investment, and

work required.

Enthusiasm for

My Brand 20%

Advance preparation, CEO involvement.

Follow-up on commitments.

Alignment with your vision.

X Factors: People, Admin.,

Professionalism, etc.

+/-

CPG/FMCG background for leaders.

Efficiency of scheduling meeting.

Office environment.

Do you enjoy the people?

Export Solutions Broker Assessment Grid

Evaluating Distributors or Brokers?

We can help!

Export Solutions performs

Distributor Search in 96 countries.

23

Strong consumer goods brokers

and importers are deluged with

representation inquiries from around

the world. The emails are usually

supplemented by a product catalog and

promise to mail a price list! In a best case

scenario, this type of approach may lead

to a request for more information from a

good broker. More likely, the broker will

skip your inquiry and move on to the

next opportunity in his mailbox. Listed

below are Export Solutions tips for

“breaking through the clutter” and

providing the right information to

generate excitement and interest from

the broker and importer community.

1. What is your Brand USP

(Unique Selling Proposition)?

USP defines your competitive edge

versus all other brands battling for the

same shelf space. The USP can revolve

around quality, value, assortment,

or packaging. However, you need

to validate your claims. For example,

a statement such as “tastes better than

competitors A & B” should be supported

by market research of consumers or blind

tests of a sufficient panel group that backs

your quality claim. Similarly, a retail price

review can demonstrate a “better value”

position. Your USP must also pass the

litmus test: Is your USP relevant to the

purchaser and consumer? For example,

you might offer the only coffee with

orange and lemon flavors, but is anyone

really looking for this product?

2. Have you done your homework

on my market?

The food/consumer goods industry

is relatively transparent. Typically,

brand owners simply need to visit the

leading supermarket chains to obtain a

“snapshot”of local category assortment,

pricing and merchandising practices.

The assortment and shelf space allocation

will provide clues regarding consumer

preferences from a taste/usage

standpoint and potential gaps in the

market. Syndicated data providers

such as Nielsen and Euromonitor supply

reams of data tracking category sales and

trends. New brand representation offers

to brokers that demonstrate a degree of

understanding of local category market

conditions will always receive an

appreciative response.

3. What will the brand owner invest?

The most important consideration after

the USP definition! A broker believes that

he needs the right financial spend levels

to aid him in achieving the results that

he is capable of. The correct spend level

usually reflects an appropriate mix of

trade development funds (listing

fees/shelf space/flier participation)

and consumer awareness activities

(sampling/pr etc.) The brand owner

must acknowledge that there are fixed

fees to enter virtually every market. Some

brokers are willing to split these fees.

It’s usually not enough to case rate

spending unless you have a very strong

proposition. Bottom line: If you are

unwilling to invest in your brand…why

should the broker invest his time and

resources building your brand?

4. Where has your brand been successful?

Your track record at building brands

counts! Share your record proudly,

particularly if the target country or

retailer is well known. On the other hand,

a “Produced in Europe” success story

may not be impactful if you don’t intend

to duplicate the conditions that brought

you success such as local production and

measurable marketing investments.

5. How tough is the job to launch your brand?

Are you attempting to enter a competitive

category dominated by heavy spending

multi-nationals? Or are you aiming at

an attractive niche? What are the brand

owners expectations in terms of product

availability and sales volume?

6. Can the broker make money

with your brand?

Brokers seek to obtain a fair profit for

their activities to support your brand.

Profit must be measured in dollars

contributed versus percent of sales.

Brokers rarely make money during year

one of an introduction as they allocate a

disproportionate share of their resources

to launch a brand. On the other hand,

new brands in current categories for

the broker can bring new profits with

minimal incremental effort. Globally

recognized brands bring prestige to a

broker’s portfolio and may serve as

a magnet to attract other brands. Brand

owners must present a convincing case to

the broker on the incremental profits that

your company can deliver to the broker’s

bottom line.

Brand Owners: What Every USA Broker Wants to Know

24

Key Contact: Telephone:

Web Site: Email:

Founding Date: Ownership:

Annual Sales: Total Employees:

0-$50 million $50 million - $250 million $250 million- $1 billion $1 billion +

% Sales International:

0-10% 10-25% 26-50% 50% +

Exporter Classification/Description:_________________________ (#1-10, based upon Export Solutions’ scale)

Core Product Range:

Unique Selling Point:

Market Share:

Home Country: Country A: Country B: Country C:

Current Business in Distributor’s Country: Yes/No: Size $:

Current Customers (Distributor’s Country):

Investment Model: Listing Fees*: Yes/No *average $35 per item,per store

Trade Promotion Budget: Dead net price: 10% of sales: Mass:

Marketing: Digital: Sampling: 360 degree:

Ambition/Size of Prize: Sales: Market Share:

Year 1

Year 2

Year 3

Exporter Data Sheet

What Distributors want to Know about Your Company

New Business Opportunity: _____________________________________

(Company Name/Country)

25

10 Questions for Every Broker Interview

1.Company History

How long have you been in business? Who are the

owners? How many direct, “payrolled” employees

do you have? Approximate annual sales volume?

2. Company Brand Portfolio

What are your top 10 companies/brands represented?

For which channels do you represent each brand?

How long have you represented each brand?

Can you provide senior level references at each

“brand owner?”

3. Key Account Buyers

Who is the buyer for our category at the largest

retailers in your market? What other brands do you

sell to our buyer? How frequently do you visit each

major customer?

4. New Product Launch Success Story

Provide a recent example of a new brand

launch success story. Key retailer acceptance?

Cost of entry? How long did it take? Key elements

of the success strategy?

5. Creative Selling

Provide an example where you took an

assigned marketing/brand support budget

and created a successful local program. How

do you measure success?

6. Retail Servicing

How many full time employees do you have visiting retail

stores? Are they located countrywide or just in the capital city?

How do you measure a “good store” in terms of brand presence

versus a “bad store?” Describe your retail reporting system.

7. People

Who would be our point of first contact? Would our contact also

“sell” our brands to major accounts? What other brands is our

contact responsible for? How do we insure that we get our fair

share of attention from your sales force?

8. Business Planning Model

What would your action plan be if we made an agreement to

start with your company? First steps? 90 Day Plan? Reporting?

9. Cost to Serve

How do you model your broker commission? Range

of commission for our brands? How do you manage

trade spending budgets?

10. Enthusiasm for our Company

Why is our brand a good match for your company?

Why are you the best partner in the market for our brand?

What commitment are you willing to make?

3 History of Success pioneering other international brands

3 Strong retail presence for current brands handled

3 Logical launch plan, category analysis, and cost structure

3 Positive references from existing brands and Dun & Bradstreet

3 Enthusiastic about your brand and the business

Greg's Guidance: Broker Assessment Criteria

26

USA: 10 Priority Investments

USA development remains a top opportunity for many European brands. Most companies sell to the USA, but maintain sales levels

far below potential. The USA is complex, with 12 trade channels, 390 retailers, 50 states, and food brokers controlling sales. Which

investments will deliver the greatest return?

Investments Strategy Insights

USA-Based

Sales Manager

Mandatory oversight of your USA development. Base salary range: $130 to $200 K.

Location: Atlanta, Chicago or close to importer.

Broker Network

Upgrade channel and regional broker networks. Brokers sell to most customers, not importers.

Bonus brokerage model works!

High Class Retailers

Build sales base with laser focus on retailers

catering to upper income consumers.

Whole Foods, Fresh Market, Harris Teeter.

"From High Class to Mass."

Trade Promotion

Customer specific promotions. Invest in retailers preferred promo vehicles.

15% TPR promotions do not excite anyone.

E-Commerce

Hire Amazon broker to create visibility.

Establish budget for pay-per-click investment.

Amazon: primary source for "homesick"

consumers looking for their favorite brand.

Export Solutions

USA market development helper for leading

European brands.

Point of difference: Sales oriented.

Targeted, logical road maps; USA solutions.

Supply Chain

Analyze options to create more cost efficient

supply chain. “Factory gate to store shelf.”

Consider USA factory or co-packer.

Regional third-party distribution centers.

Sampling

Maximize consumer trial. Direct to consumer,

multi-product, sample boxes are popular.

Everyone loves free trial sizes.

Costco sampling drives sales volume.

Data

Leverage category data to sell your brand.

Nielsen and IRI are respected.

USA buyers require detailed analytics for new

listings, not just a nice story.

Retail Safari

Spend 25 percent of your time visiting stores.

"Retail University."

"Retail Reality", not board room promises.

Atlanta, Dallas, LA = real USA (not NYC/Miami).

Hire a USA Expert

• USA strategy recommendation

• Category analysis and

plan development

• Identify priority channels,

regions, and retailers

• Broker/Distributor

identification specialist

• Have a USA pro with 20+ years

experience on your team

Contact Greg Seminara at

greg@exportsolutions.com to

discuss your USA development project.

www.exportsolutions.com

27

Introducing

America’s Favorite Brands

Executive Board

Export Solutions Smucker’s Tabasco

Greg Seminara, CEO Danny Berrios, President Megan Lopez, Vice-President

General Mills Sun-Maid

Eric Saint-Marc Carsten Tietjen

Advisory Board

Bazooka Candy Blue Diamond Bob’s Red Mill

Santiago Ricaurte Dale Tipple Jan Chernus

Bush Beans Campbells Church & Dwight

Dave Bauman Julio Gomez Arun Hiranandani

Ferarra Candy Heartland Idahoan

Daniel Michelena Tom Theobald Ryan Ellis

Johnsonville Sausage Kao USA Keurig Dr. Pepper

Cory Bouck Julie Toole Billy Menendez

Mizkan Reynolds Welch’s

Noel David Chris Corey Marc Rosen

19 Companies | 200+ Top Brands | $80 Billion Combined

View our activities for export managers – www.usafoodexport.com

2828

Slotting allowances, listing fees or as the Irish say “Hello”

money are all real estate rental fees charged in advance by

retailers for access to their limited shelf space. Many retailers

assign their buyers “budgets” for this type of incremental fee

income. Store owners seek to obtain maximum productivity

from each shelf facing and fixed entry fees are a tactic to gain

immediate income from new products without an established

sales history. At the end of the day, it’s a cost of doing

business. Our objective is to allocate as little money

as possible to listing fees to redirect our investments

to consumer awareness and trial generating activities.

Recapped below are Export Solutions’ Ten Tips on

minimizing listing fee payments.

1. Exclusivity

Some large retailers will waive listing fees in order to achieve

first in the market status with an exclusivity arrangement.

Normally, this extends for three to six months. Beware, you

may upset other customers who become “locked out” during

the exclusivity period.

2. Pay Fees Over One Year

This approach reduces your initial outlay and also increases

the likelihood that the retailer will keep your product on

the shelf for at least one year. This may also allow you to

structure the payment as a percent of case cost versus a

“lump sum” payment.

3. Free Goods

Our net cost of “Free Goods” may range from 30-50% of a

product’s retail price to the consumer. The retailer recoups

his listing fee when the product is sold. Some retailers are

hesitant to accept this option, as a slow moving brand may

force him to wait to receive his money.

4. Approach “Non-Slotting” Fee Retailers First

Every country includes retailers and channels that do

not demand slotting fees. Create a success story with these

customers first. Your track record may validate the larger

investment in paying the fees at a bigger account or success

may help you negotiate more favorable terms.

5. Create “All Inclusive” Annual Plan

Ultimately, the retailer has many “profit centers” to reach their

internal financial targets. Customers respect a solid, year one

plan, with investments in their other programs like advertising,

sampling, shelf rental and display. You may secure your product

listings as part of your annual agreement.

6. Negotiate Reductions – Multiple Items

My experience is that many retailers have published standard

prices for listing fees. However, net payment often depends

on your distributor’s clout. Big distributors, representing

multinational’s and a wide variety of brands know the difference

between what is requested and what is really paid on high profile

brand launches where the retailer needs the new brand to be

competitive. The most frequent “discount” is receiving a reduced

fee for multiple items: example, paying a full listing fee on first

two items and receiving authorization for two extra items as part

of a group listing.

7. Retailer Entertainment

Most countries still permit buyers to socialize with suppliers.

The cost of a few tickets to a high profile sporting event is far less

than most listing fees. A VIP plane trip to view your factory or

your category in a “resort” country is another way to gain access

to the shelves without writing a big check.

8. Higher Everyday Margin

Total category margin is a key assessment metric for most buyers.

Some may consider a lower listing fee, if your brand delivers a

margin higher than the category average.

9. Distributor Contribution

Some “hungry” distributors may cover or co-fund listing fees.

There are options to “case rate” fixed fees into the distributor

margin calculation. Ultimately, distributors benefit from increased

sales and margin contribution from a new product listing.

However, many are reluctant due to short term contracts. Most

maintain policies related to brand owners retaining 100 percent

responsibility for listing fees and consumer marketing activities.

10. Beg! Claim Poverty

Buyers are human and realists too. They may “bend” in their

demands if they like your brand and know that you represent

a small company. Long term distributors can request the

occasional “favor” from a friendly buyer. Most retailers have

programs to provide “low cost” chances to entrepreneurial

new or local suppliers.

Ten Tips: How to Minimize Listing Fee Payments

Create Your Own

Export Library

All Guides available free at

www.exportsolutions.com

in the Export Tips section.

Distributor Search Guide

Export Handbook

Selling to USA Handbook

Distributor Management Guide

Finance & Logistics

Export Treasure Chest

My Favorite Templates & Forms

People Power

Strong Teams Build Great Brands

29

1. Case

Manufacturer supplies a business case

confirming brand “aspirations” for the